Over the last two years, U.S. import duties on EU spirits have been anything but stable. After the 2023 suspension of tariffs on Cognac, Scotch, and other categories, producers enjoyed a brief period of calm. But in 2024, trade tensions resurfaced, and recent news points to a possible +15% duty on EU spirits. For any producer exporting to the U.S., this is a wake-up call. Our article from 2019 examined strategic approches to mitigate increases. This time we dive a bit deepter with “what ifs…” and a closer look at the distribution chain.

Why Scenarios Matter

Duties are uncertain. They can appear overnight, and disappear just as quickly under political negotiation. Since duties enter the value chain at the importer level, they ripple through the entire distribution system. Without scenario planning, a sudden tariff can leave producers and their partners scrambling—either accepting volume losses or sacrificing margins.

Case Study: Cognac XO in New York

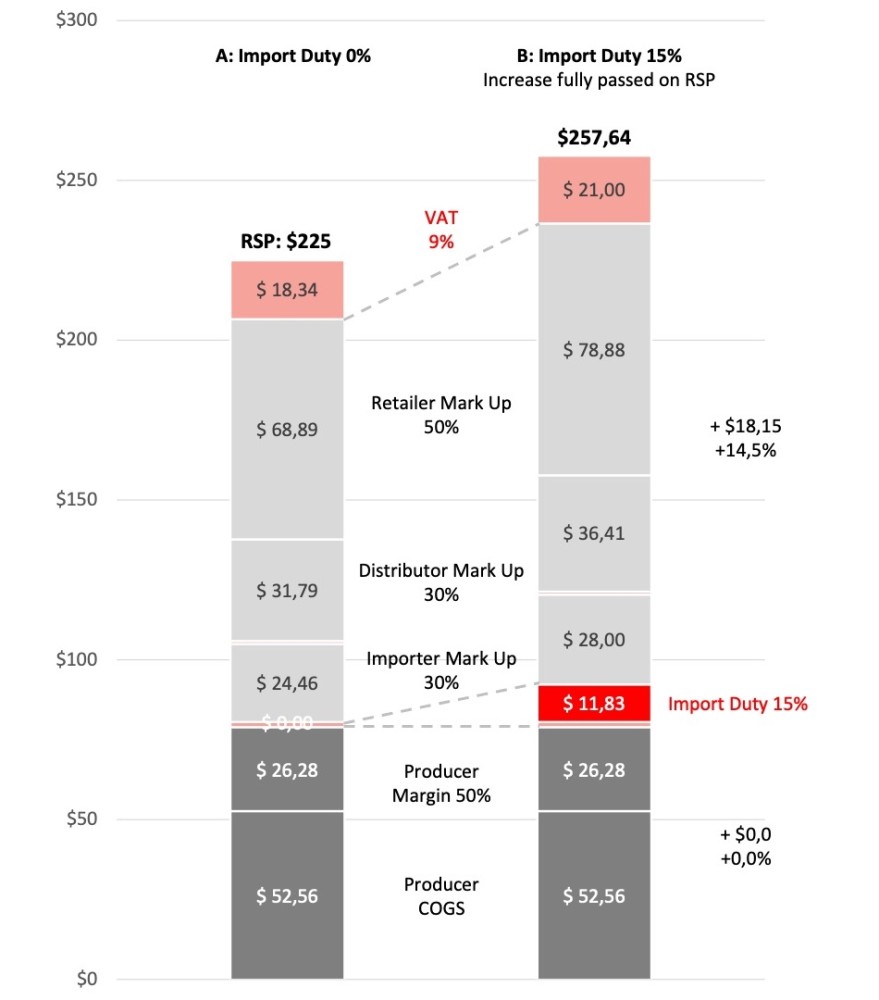

Let’s take the example of a Cognac XO selling in New York State at $225 RSP (Retail Shelf Price). To understand the impact, let’s build the value chain: from producer to importer, distributor, and retailer (Fig A). The producer earns roughly $26 per 75cl bottle, while the importer, distributor, and retailer apply 30–50% markups each. When a 15% import duty is introduced, it is paid by the importer—but then enters the markup base for all players. This creates an amplification effect on the final RSP.

Scenario Analysis

In our scenario analysis for this Cognac XO in New York, the baseline RSP is $225 (A). If a 15% import duty is fully passed on (B), the RSP jumps to $257,64 (+14,5%).

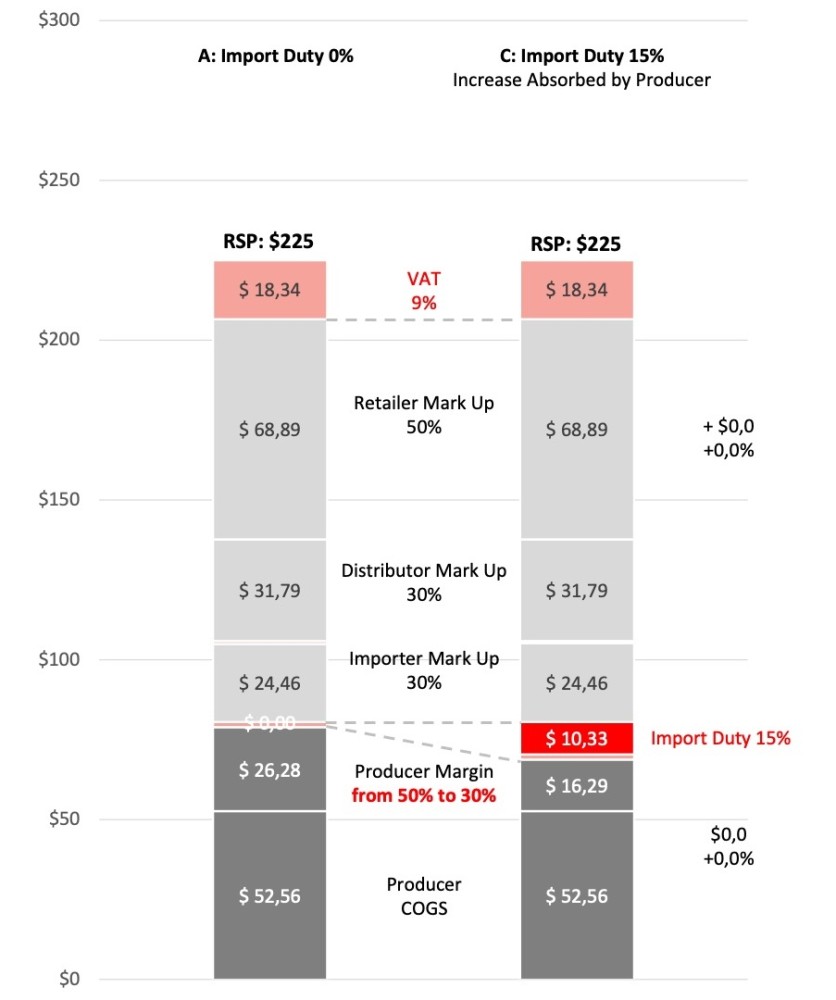

Alternatively, if the producer absorbs the duty (C), the RSP stays $225, but producer margin collapses from 50% to roughly 35%. Obviously this situation is created to put imported products under pressure vs. domestic alternatives at the expense of consumers.

In reality, the optimal path lies between these extremes. Importers, distributors, and retailers—who collectively capture more than half of the value chain—must / can arguably share the burden. These scenarios and transparent discussions help align all parties and maintain competitiveness and are a real test to the Producer relations with its commercial partners in the U.S.

Key Takeaways

1. Map your value chain and understand who earns what.

2. Model multiple scenarios to anticipate different duty levels.

3. Engage your partners early to share responsibility and avoid last-minute chaos.

Tariffs are not a one-off headline—they are an ongoing strategic challenge. With the right data and scenario planning, you can protect both volume and profitability, even in volatile trade. Need help on Pricing and Promotion – and Duties – Strategies ? At Brand Reveal we can help decomplexify this topic and map smart ways forward. [email protected]